georgia personal property tax exemptions

And according to the Tax Foundation one of 16 other states implementing tax reform in the past 18 months. Georgia now joins Iowa and Mississippi as the third state this year to amend its tax code for a flat rate.

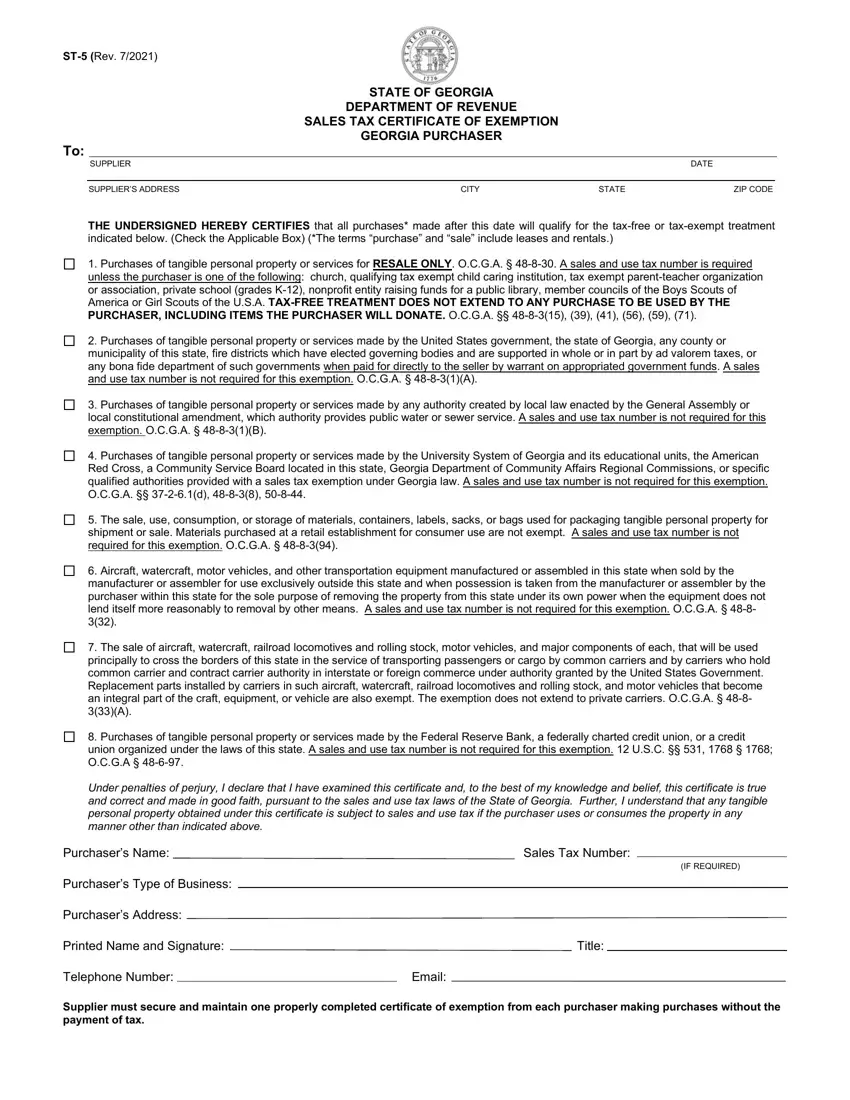

Georgia Form St 5 Fill Out Printable Pdf Forms Online

New signed into law May 2018.

. 8 rows Individuals 62 Years of Age and Older. May 1 May 31 will receive 5833. The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the.

Change to Georgia Personal Exemption Amounts. Almost all 93 percent of Georgias counties and over 140 of the cities have adopted. Inventory must be reported on the return but more than 90 of Georgia counties have adopted some level of exemption for inventory via the Freeport Exemption see below for details.

The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are. April 2 April 30 will receive 6667 of the full exemption. And federal government websites often end in gov.

While the state sets a minimal property tax rate each county and municipality sets. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. 1437 also increases the personal exemption amounts.

The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional. Part 1 - Tax Exemptions. The exemption amounts for late filed applications and supporting documentation are as follows.

Co-located data centers and single. I II III IV V VI VII VIII IX X XI. 42 - Georgia Personal Exemptions Georgia has no personal exemption.

To see a complete list of forms click here. In a county where the millage rate is 25 mills the property tax on that house would be 1000. Individuals who are 62 or older and live in a school district.

Georgia exempts a property owner from paying property tax on. Business inventory is exempt from state property taxes as of January 1 2016. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of.

Property exempt from taxation. GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in. GDVS personnel will assist veterans in obtaining the necessary documentation for.

25 for every 1000 of assessed value or 25 multiplied by 40 is. State of Georgia government websites and email. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

2007 Sutherland Asbill Brennan Llp Introduction To Georgia Property Tax For Non Profits Charlie Kearns Sutherland Asbill Ppt Download

Gsccca Org Pt 61 E Filing Help

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Georgia Form St 5 How To Complete 2012 Fill And Sign Printable Template Online Us Legal Forms

Business Personal Property Tax Bills Meet Resistance Indiana Chamber Of Commerce

A Guide To Georgia Business Personal Property Taxes

Understanding Your Property Tax Bill Department Of Taxes

Ga Dor St 5 2016 Fill Out Tax Template Online Us Legal Forms

Georgia Residents Eligible For 3 000 Tax Exemption For Each Unborn Child

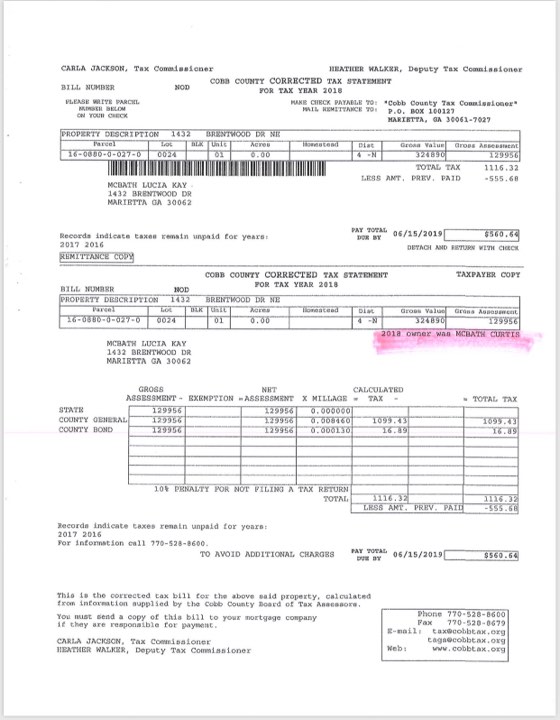

2021 Property Tax Bills Sent Out Cobb County Georgia

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube

A Guide To Georgia Business Personal Property Taxes

Veteran Tax Exemptions By State

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Calculator Smartasset

Georgia Department Of Revenue Caveat 2010 Mav For Personal Property Expanded Freeport Inventory Elimination Of Ad Valorem Tax On Business Inventory Heavy Ppt Download